BTC Price Prediction: Analyzing Investment Potential in Current Market Conditions

#BTC

- Technical indicators show BTC trading above key support levels with bullish momentum

- Growing institutional adoption and macroeconomic factors support positive outlook

- Record mining difficulty indicates network strength despite price volatility

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

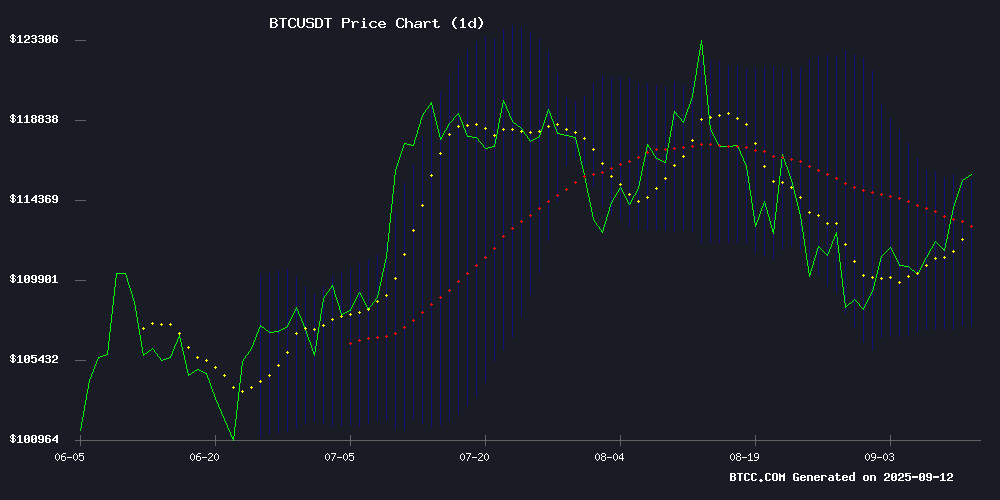

BTC is currently trading at $116,400, positioned above its 20-day moving average of $111,449.57, indicating sustained bullish momentum. The MACD reading of -89.64 suggests some near-term consolidation, though the overall trend remains positive. According to BTCC financial analyst William, 'The price holding above the middle Bollinger Band at $111,449.57, while approaching the upper band at $115,675.15, signals strength. A breakout above this resistance could target new highs.'

Market Sentiment: Institutional Adoption and Macro Trends Support BTC Outlook

Recent developments including Africa Bitcoin Corporation's treasury strategy launch and growing expert interest in crypto derivatives reflect increasing institutional adoption. BTCC financial analyst William notes, 'The convergence of macroeconomic tailwinds and record mining difficulty despite volatility demonstrates underlying network strength. These fundamental factors, combined with technical positioning, support a constructive year-end outlook for Bitcoin.'

Factors Influencing BTC's Price

Africa Bitcoin Corporation Launches Continent's First Bitcoin Treasury Strategy

Johannesburg-based Altvest Capital has rebranded as Africa Bitcoin Corporation (ABC), marking the continent's inaugural Bitcoin treasury initiative. The firm acquired 1.00464 BTC at approximately R1.8 million ($98,000) as its foundational reserve asset.

ABC's leadership frames Bitcoin as Africa's natural hedge against currency volatility and banking exclusion. "Bitcoin is made for us," declared executives during a live X broadcast, citing the continent's 43% unbanked population and chronic fiat devaluation as key adoption drivers.

The treasury strategy aims to preserve shareholder value through BTC's global liquidity while raising R200 million for additional acquisitions. This institutional pivot mirrors growing corporate Bitcoin adoption worldwide, though ABC represents Africa's first dedicated BTC treasury vehicle.

7 Expert-Level Tactics to Multiply Your Gains with Crypto Derivatives in a Bull Run

Crypto bull runs are transformative periods marked by surging prices, overwhelming demand, and unshakable investor optimism. Assets from Bitcoin to altcoins can triple or quadruple in value within weeks, drawing both retail traders and institutional capital into the frenzy. Yet this euphoria carries risks—impulsive FOMO-driven decisions often erase gains as swiftly as they arrive.

Disciplined investors recognize that spot trading alone isn’t enough. Derivatives—contracts deriving value from underlying assets—emerge as critical tools for amplifying returns and managing risk. Futures, options, and perpetual swaps allow traders to hedge positions, leverage exposure, and capitalize on volatility without direct asset ownership.

The current rally, fueled by institutional adoption and macroeconomic tailwinds, demands sophistication. Those who master derivatives gain asymmetric advantages: structured products for yield generation, arbitrage strategies to exploit inefficiencies, and dynamic hedging to protect downside. The bull market rewards preparation as much as participation.

Bitcoin Poised for Year-End Rally as Macroeconomic Tailwinds Converge

Bitcoin's record-breaking performance in 2024 sets the stage for a potential surge beyond $150,000 by year-end. The cryptocurrency has already notched ten new all-time highs this year, with current prices hovering just 9% below the $124,290 peak.

Three powerful catalysts are driving bullish sentiment. The Federal Reserve's anticipated rate cut next week could mark the beginning of an aggressive easing cycle, with BlackRock and Fed Governor Christopher Waller both signaling imminent policy shifts. This dovish pivot aligns with a global trend - 88 rate cuts have already occurred worldwide in 2024.

Institutional accumulation reaches unprecedented levels as private sector buyers and nation-states exhibit classic FOMO behavior. The expanding money supply, growing at 7% annually in the US and 9.3% globally, creates ideal conditions for hard assets like Bitcoin to appreciate.

Bitcoin Mining Difficulty Hits New Highs Despite Price Volatility

Bitcoin's price action remains locked in a tight range between $110,000 and $113,000, reflecting a market in equilibrium. Buyers defend the lower bound while sellers cap rallies near $113,860—a level coinciding with the 200-day moving average. This consolidation occurs against a backdrop of macroeconomic uncertainty, yet network fundamentals tell a different story.

Mining difficulty has reached another all-time high, signaling unwavering commitment from miners despite price fluctuations. The hashrate resilience suggests long-term confidence in Bitcoin's value proposition, even as short-term traders grapple with liquidity shifts. Such divergence between price and network strength often precedes significant breakout movements.

Is BTC a good investment?

Based on current technical indicators and market developments, BTC presents a compelling investment opportunity. The price trading above key moving averages, combined with positive institutional adoption trends and macroeconomic support, suggests continued upward potential. However, investors should consider their risk tolerance given cryptocurrency volatility.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $116,400 | Above 20-day MA |

| 20-day Moving Average | $111,449.57 | Support level |

| Bollinger Upper Band | $115,675.15 | Near-term resistance |

| MACD | -89.64 | Short-term consolidation |